Google Stock's Dip: What's Behind the Drop and What's Next

Buffett Bites: Did the Oracle Finally Drink the Google Kool-Aid?

So, Warren Buffett, the guy who famously sticks to what he knows – insurance, candy, and railroads – apparently just dropped $4.3 billion on Alphabet (that's Google's parent company for those living under a rock). Color me skeptical.

The Old Guard Embraces… AI?

Buffett, bless his 95-year-old heart, has always been Mr. Anti-Tech. He's the dude who probably still uses a flip phone and sends handwritten letters. Now, suddenly, he's all-in on the AI hype train? Something smells fishy, and it ain't the Berkshire Hathaway annual picnic.

He even admitted he “blew it” by not investing in Google earlier. Give me a break.

Look, Alphabet is crushing it. Their stock's up 46% this year, fueled by the whole AI frenzy. And yeah, Gemini AI app boasts over 650 million monthly users. But Buffett? Buying now, at what might be the absolute peak of the hype? It's like watching your grandpa try to breakdance – impressive, sure, but also kinda sad.

Maybe it wasn't even Buffett's call. The article mentions his investment managers, Todd Combs and Ted Weschler, might have pulled the trigger. Which raises a bigger question: is Buffett even running the show anymore? Or is he just a figurehead while the "young guns" (relatively speaking) make the real decisions? I mean, he's stepping down as CEO before the new year anyway. Is this his last hurrah, or someone else's power play?

Europe's Still Got It Out for Google

And speaking of Google, let's not forget about the EU breathing down their necks again. The European Commission is launching yet another investigation into whether Google's being a monopolistic jerk. Apparently, they think Google's "site reputation abuse policy" unfairly punishes news outlets.

If the E.C. finds against Google, they could get slapped with a fine of up to 10% of their global turnover. That's potentially $77 billion! Now, I doubt that'll actually happen. Google will probably just tweak its policy and call it a day. But it highlights the constant risk of investing in a company that's basically public enemy number one in Europe.

Is it really worth the headache? Alphabet's market cap is insane at $3.4 trillion. But with that kind of size comes intense scrutiny. It's like being the quarterback of the football team – everyone's watching, and every mistake gets magnified.

Berkshire also trimmed its Apple position by 15% and its Bank of America stake by 6%. So, they're selling off the old reliables to gamble on AI? It's like selling your house to buy lottery tickets. Maybe Buffett knows something we don't, but I'm not convinced.

The article says Buffett struck an optimistic tone in his Thanksgiving letter, claiming he still sees opportunities. But let's be real, what else is he gonna say? "Yeah, I'm old, the market's rigged, and I have no idea what I'm doing"? Offcourse not.

Berkshire's sitting on a mountain of cash - $358 billion, to be exact. And Greg Abel, Buffett's successor, is gonna have to figure out what to do with it all. That cash pile is a double-edged sword. It's great to have options, but it also creates pressure to make a big move. And big moves can backfire spectacularly.

Is This the Beginning of the End?

Buffett's been doing this for six decades. He turned a failing textile mill into a trillion-dollar empire. But every empire eventually crumbles. Is this Alphabet investment the first crack in the foundation? Are we watching the Oracle of Omaha lose his touch?

Then again, maybe I'm just being cynical. Maybe Buffett really does see something special in Alphabet. Maybe AI is the future, and he's just getting in on the ground floor. But forgive me if I don't join the party just yet. I'll stick to my value stocks and wait this one out.

So, What's the Real Story Here?

Buffett's Alphabet gamble feels less like a calculated move and more like a desperate attempt to stay relevant. He's chasing the shiny new object while the rest of his empire slowly decays. And honestly, it's a little sad to watch.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

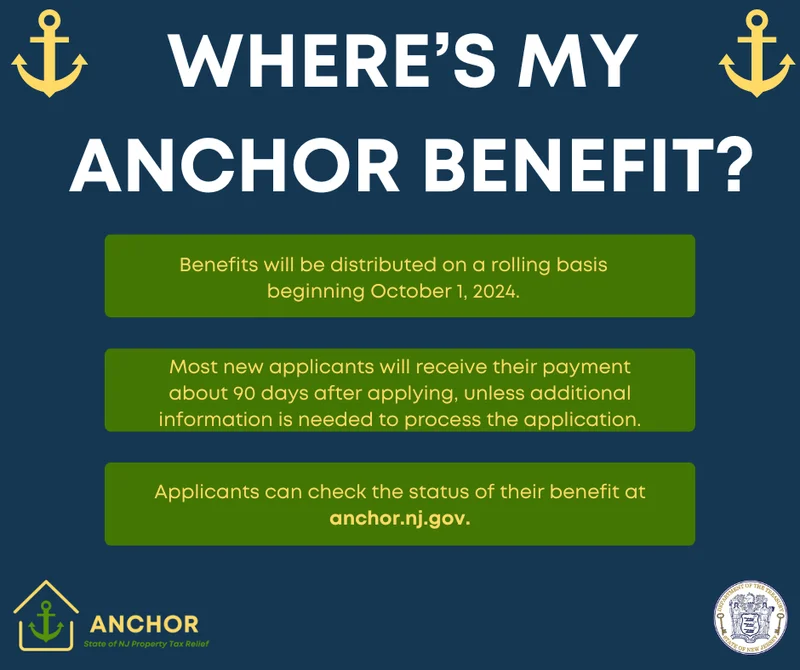

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: The Split, Price Today, and What's Next

- NVDA Earnings: What to Expect and When – The Future is Coming

- Pump.fun: Price predictions and... why?

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)