XRP Price: Whale Activity, Predictions, and What's Next

Can XRP's ETF Launch Unlock a $5 Price Target? The Future is Calling

Okay, friends, buckle up. We're not just talking about another cryptocurrency blip today. We're talking about a potential paradigm shift—a moment where XRP, yes, that XRP, could finally break free and redefine its trajectory. I'm honestly buzzing with excitement just thinking about it.

You see, Canary Capital dropped their XRP ETF and the market's reaction was…well, it was something. Initial reports are showing it posted record trading volumes right out of the gate, pulling in roughly $245 million on its first day. I mean, that's not just dipping a toe in the water; that's diving headfirst into the deep end! This makes it the biggest ETF debut of 2025, barely edging out the Solana ETF launch from last month.

The ETF Effect: More Than Just Hype?

Now, skeptics will say, "Dr. Thorne, it's just another hype cycle." And sure, we saw XRP jump to nearly $2.50 before settling back down. Classic "sell-the-news" behavior, right? But I think there's a much bigger picture here. This isn’t just about short-term gains; it’s about legitimacy, accessibility, and opening the floodgates to institutional investment.

Think about it: for years, XRP has been somewhat sidelined, waiting for its moment. This ETF? It’s the key to unlock Wall Street. It's the on-ramp for major players who've been hesitant to dive into the crypto world directly. We're talking about pension funds, hedge funds, and all those big institutions that need a regulated, secure way to get exposure to XRP.

Bloomberg analysts Eric Balchunas and James Seyffart noted that XRPC and BSOL are in a league of their own.

This is a sea change.

And the numbers don't lie. The XRPC ETF logged around $58 million in volume on its first trading session. Let me repeat that: $58 MILLION! That’s more than Bitwise’s Solana fund (BSOL), which held the previous record. People are pouring money in fast, with $26 million in the first 30 minutes alone.

What does this mean? XRP has been engineered for the big leagues. This is not financial advice, but even I can see where this is going!

Now, it’s crucial to be realistic. An ETF alone won't magically solve all of XRP's challenges. We need to see genuine adoption of XRP in financial systems, not just investor enthusiasm. But this ETF? It's a catalyst. It makes it easier for capital to flow in, potentially on an ongoing basis. Can Canary Capital’s XRP ETF Ignite an XRP Price Surge?

Ripple raising $500 million at a $40 billion valuation from Citadel Securities and Fortress sends a clear message. These aren't firms that make symbolic bets. They believe in Ripple's payments infrastructure and XRP's strategic role. And with Ripple's banking network passing 300 financial institutions worldwide, the foundation is there.

The question now isn’t if XRP will succeed, but how big it can get. JPMorgan analysts estimate a spot XRP product could attract up to $8 billion, and some are forecasting a $5 price target by late 2025. Now, I'm not one for making specific price predictions, but imagine the possibilities.

Of course, with great power comes great responsibility. We need to ensure that this technology is used ethically and responsibly, that it benefits everyone, not just a select few. But I firmly believe that XRP has the potential to revolutionize global payments, to make them faster, cheaper, and more accessible to everyone.

The Future is Unfolding

Canary Capital’s XRPC launch is not just a win for XRP's supporters; it's a win for the entire crypto ecosystem. It's a sign that institutional investors are finally taking altcoins seriously. The next few weeks will be critical. Will Wall Street's embrace become a long-term catalyst, or just another bright moment? I, for one, am incredibly optimistic. The future is unfolding, and XRP is poised to play a major role.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

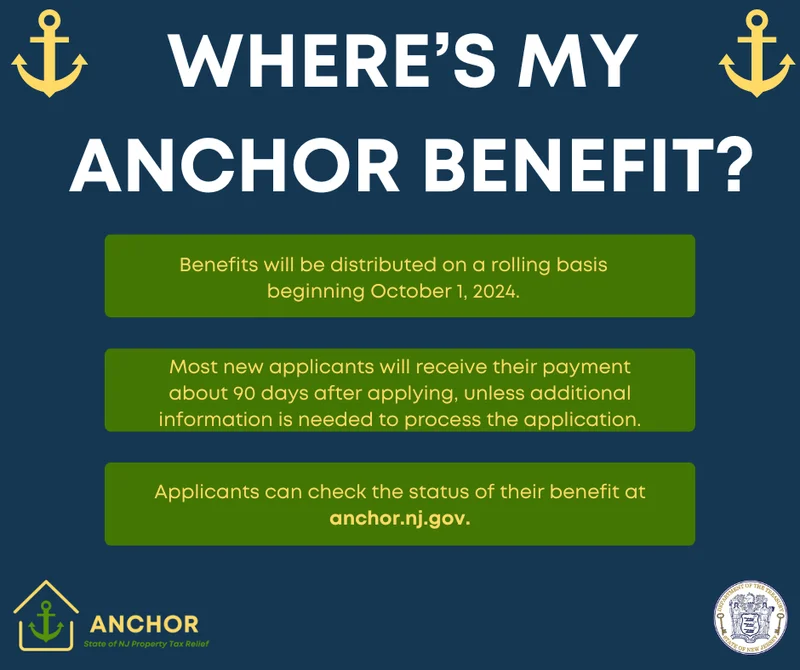

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Starknet Token Price Surge: What's Behind the Rally?

- Zcash Price Surge: What's Driving the Crypto Rally and Bitcoin's Shadow?

- Stocks Futures Flat: What's Going On?

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)