Microsoft Stock: Price Trends and Investor Sentiment

Microsoft's AI Spending Spree: Is It Really Worth It?

Microsoft is all-in on AI, that's clear. Baird analyst William Power initiated coverage on Microsoft with a $600 price target, touting the company as "leading the AI revolution." Top Baird Analyst Initiates Coverage on Microsoft Stock (MSFT), Says It Is ‘Leading the AI Revolution’ MSFT stock is up 21% year-to-date. But let's dig deeper than the headlines and analyst hype. Are they really "leading" or just spending the most? And is that spending sustainable?

Cracks in the Foundation?

The Gates Foundation Trust slashed its Microsoft stake by roughly 65% in Q3 2025, regulatory filings show. That's about 17 million shares, valued at $8.7–$8.8 billion. The official line is that this is just portfolio management to fund philanthropic commitments. (Right. And I'm sure they wouldn't also want to take profits after a massive run-up). GuruFocus calls it "a portfolio and liquidity management decision, not a vote of no confidence." But the sheer size of the sale is hard to ignore. It does makes you wonder...

Meanwhile, Peter Thiel’s investment firm, Thiel Macro LLC, has fully exited Nvidia and shifted focus toward Microsoft and Apple. Is this a ringing endorsement? Maybe. Or maybe Thiel, who's been vocal about AI valuation bubbles, is just rotating into safer, less volatile bets.

The real story isn't just who's buying or selling, but why. Microsoft's fiscal Q1 2026 showed revenue of $77.7 billion (up 18% year-on-year) and EPS of $4.13. Seems great, right? But look closer: AI and cloud capex is exploding, pushing toward $30–35 billion per quarter. Microsoft's cash and short-term investments have fallen from about 43% of total assets in 2020 to just 16% now.

That's a massive shift.

Microsoft's operating margin is still north of 40%, and net margin is around 35%. Debt-to-equity is a conservative 0.17, and the current ratio is about 1.35. The company looks financially sound. But free cash flow is under pressure. The stock trades at a P/E above 36, a P/S around 13, and a P/B over 10 – rich multiples that demand those AI investments pay off big.

The AI Treadmill

This brings us to the core question: Is Microsoft's AI "super-cycle" a value-creation machine or a capital-intensive treadmill?

It's easy to get caught up in the AI hype. Mustafa Suleyman, Microsoft’s AI CEO, calls superintelligence an “anti-goal,” aiming instead for “humanist superintelligence.” Sounds good in theory. But what does it mean for the bottom line? The move may also temper the most speculative expectations about runaway AGI profits, keeping the focus on more realistic, incremental gains from Copilot, Azure AI, and enterprise automation.

Microsoft is backing the "GAIN AI Act," which tightens restrictions on exporting high-end AI accelerators to China and prioritizes U.S. domestic orders. In a world where AI compute is the new oil, guaranteed supply can be a competitive edge.

Microsoft's management is guiding to even higher capex over the coming year. I've looked at dozens of these reports, and usually you see a decrease in spending after an initial investment. So, what's different here?

Is Microsoft overspending on GPUs and CPUs to increase capacity needed to fulfill AI and cloud demand? Microsoft has reduced stock buybacks so that it can increase capex without straining its balance sheet. Long-term investors would probably prefer that Microsoft invests in ideas that can boost its operating income rather than just reducing its share count with buybacks. However, the move does add pressure on ideas to pay off.

The Market's Verdict

Microsoft fell just 0.1% on Nov. 7, extending the stock's consecutive down days to eight. 1 Top Growth Stock Down 8% to Buy After Its Recent Pullback Reports indicate that the eight-session losing streak is Microsoft's longest since 2011. And it comes on the back of Microsoft's first-quarter fiscal 2026 earnings, which were released on Oct. 29.

The sell-offs in prominent AI stocks show that the AI investment narrative is maturing. Instead of reacting positively to AI spending announcements, investors want to see a clear roadmap for AI investments to pay off.

Despite the volatility and the capex worries, Wall Street remains firmly bullish on Microsoft. 32–35 sell-side analysts currently rate MSFT a “Strong Buy”, with average 12-month price targets clustering around $630–$633 per share – implying roughly 20–25% upside from the $510 region.

The Hype Train Needs Brakes

Microsoft is betting big on AI, but the data paints a mixed picture. While revenue is growing, the exploding capex and shrinking cash position raise serious questions about long-term sustainability. Wall Street's "Strong Buy" ratings feel more like wishful thinking than data-driven analysis.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

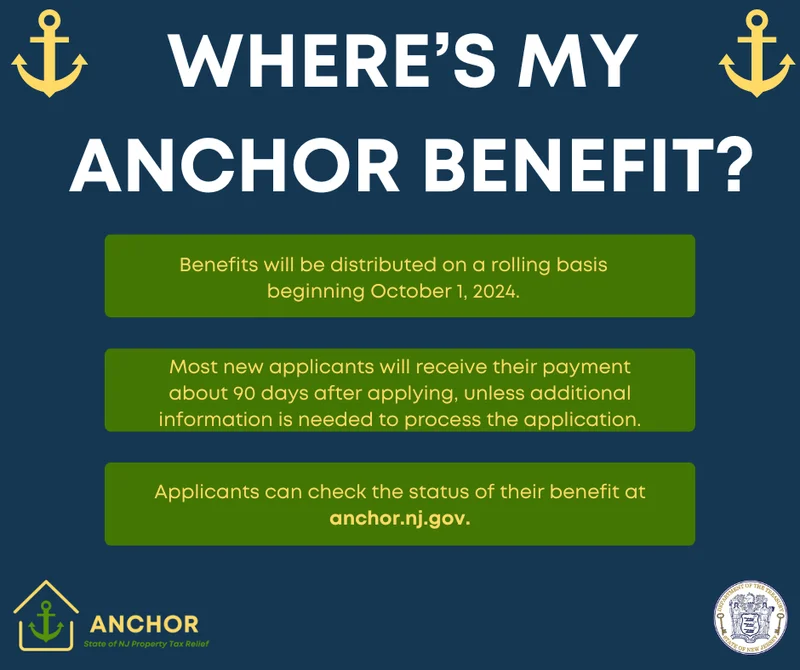

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- NVDA Earnings: What to Expect and When – The Future is Coming

- Pump.fun: Price predictions and... why?

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Starknet Token Price Surge: What's Behind the Rally?

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)