MSTR Stock Under Pressure: What We Know and Why It Matters

MicroStrategy: More Than Just a Bitcoin Play? Why the Future is Brighter Than You Think

Okay, folks, buckle up, because we need to talk about MicroStrategy (MSTR). I know, I know, the headlines are screaming "Bitcoin plunges!", "MSTR stock tanks!", and, well, generally painting a picture of doom and gloom. But here's the thing: sometimes the most exciting breakthroughs happen when everyone else is looking the other way. And I think that's exactly what's happening with MicroStrategy right now.

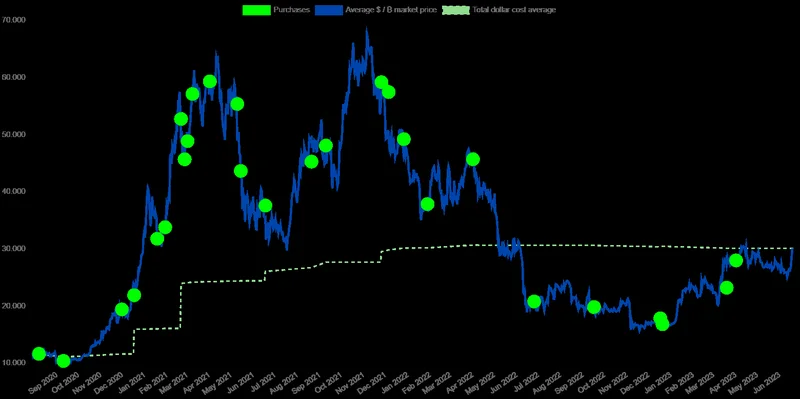

Let's be honest, MSTR has become almost synonymous with Bitcoin. The stock price dances to Bitcoin's tune, and Michael Saylor's "HODL" tweets have become legendary – especially the one with the burning ship! You see articles like, "Strategy Shares Plunge as Bitcoin Retreats—More Pain Ahead?" and it's easy to get caught up in the negativity. But what if we're missing the forest for the trees? What if MSTR's Bitcoin strategy, while undeniably risky, is actually paving the way for a much bigger, much more revolutionary future?

Beyond the Bitcoin Hype: A Glimpse of the Future

Think about it this way: MicroStrategy isn't just holding Bitcoin; they're building an entire financial ecosystem around it. They're exploring international markets, considering ETFs backed by their preferred shares, and even launching Euro-denominated preferred shares. This isn't just about speculation; it's about creating new financial instruments, new ways for people to access and interact with the digital economy. It's like the early days of the internet – everyone was focused on email and websites, but the real revolution was the underlying infrastructure that allowed for everything else.

And that infrastructure is exactly what MSTR is building. They're essentially creating a bridge between the old world of traditional finance and the new world of decentralized crypto. A bridge that could unlock trillions of dollars in value.

Consider their recent move to raise the dividend on their preferred shares to 10.5%. Some see it as a desperate attempt to revive sluggish demand. But I see it as a smart move to attract a new class of investors – investors who are looking for yield in a low-interest-rate environment but are also intrigued by the potential of Bitcoin. They're creating a product that appeals to both worlds.

I mean, look at the analyst ratings! Even with the recent volatility, a huge majority – 12 out of 15 – still rate MSTR as a "Strong Buy." And the average price target? A whopping $523, more than double the current level. These analysts aren't blind to the risks, but they do see the potential.

The dip in MSTR stock price, the shrinking premium over Bitcoin holdings, the worries about shareholder dilution – all of these are legitimate concerns. But they're also the growing pains of a company that's trying to do something truly groundbreaking. It's like when Tesla was struggling to ramp up production of the Model 3 – everyone was writing them off, but they persevered, and now they're one of the most valuable companies in the world.

What really excites me is the potential for MSTR to become a pioneer in Bitcoin-backed financial products. Imagine a world where you can use your Bitcoin as collateral for a loan, or invest in a bond that's backed by a portfolio of cryptocurrencies. This is the kind of innovation that could truly revolutionize the financial system.

Of course, there are risks. The price of Bitcoin could crash, regulations could change, or MSTR could simply fail to execute its strategy. But the potential reward is so enormous that it's worth taking the risk. And honestly, that's why I got into this field in the first place!

The company's aggressive fundraising strategy has sparked worries about shareholder dilution, while the premium investors once paid for MSTR shares over its Bitcoin holdings has shrunk dramatically. So, the question is, how do they keep the momentum going?

It's Not Just About Bitcoin; It's About Building the Future of Finance

Let's not forget the ethical considerations. With great financial power comes great responsibility. MSTR needs to be mindful of the risks involved in creating these new financial products and ensure that they're not exploited by bad actors. We need transparency, regulation, and a commitment to protecting investors.

But even with these challenges, I remain incredibly optimistic about MicroStrategy's future. They're not just a Bitcoin holding company; they're a financial innovator, a pioneer in the digital economy. And as the world becomes increasingly digital, their vision will become increasingly relevant.

The Dawn of a New Financial Era

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

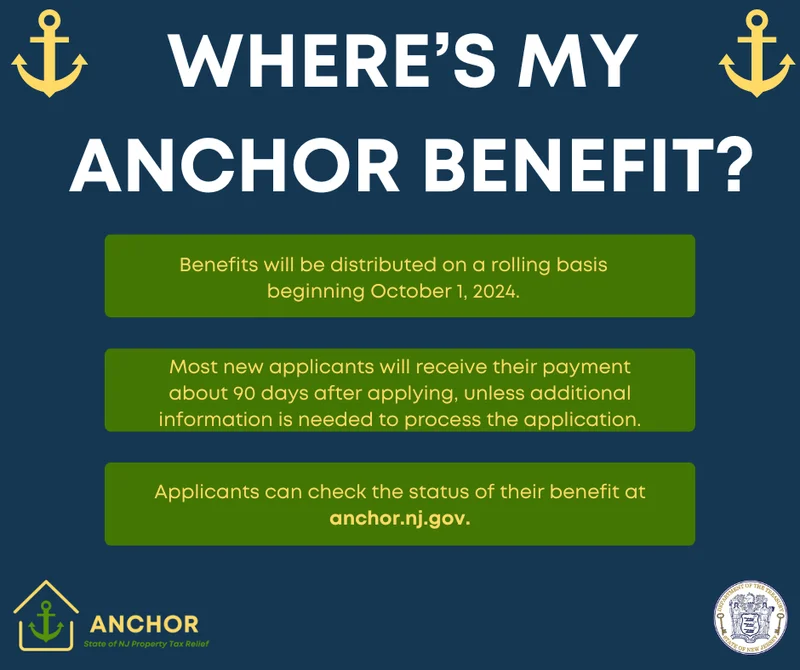

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- NVDA Earnings: What to Expect and When – The Future is Coming

- Pump.fun: Price predictions and... why?

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Starknet Token Price Surge: What's Behind the Rally?

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)