Netflix Stock: The Split, Price Today, and What's Next

Netflix's Stock Split: A Magician's Trick or a Smart Play?

Netflix (NFLX) executed a ten-for-one stock split recently, and the financial world barely blinked. Shares are "little changed," as one report noted. But does this lack of movement mean it was a pointless exercise, or is there more beneath the surface? Let's dive into the numbers.

The Split Itself: Math That Matters (and Doesn't)

The immediate impact of a stock split is, mathematically, zero. As the reports correctly state, it doesn't change the underlying value of the company or the equity held by shareholders. If you owned one share worth $1,000, you now own ten shares worth $100 each. The pie is sliced into smaller pieces, but the total amount remains the same. This is Econ 101 (or, as I like to call it, "arithmetic").

So, why do it? The stated reason, as Netflix announced in October, was to make the stock "more accessible for employees who participate in the company’s stock option program." This argument hinges on the idea that a lower nominal stock price makes it easier for employees to exercise their options and acquire shares. It’s a psychological play, banking on the perception of affordability.

But is it actually about the employees? Or is it a calculated move to attract retail investors? A lower stock price can make a stock seem more attractive to smaller investors who might be put off by a high per-share cost. The theory goes that more retail investors buying in could drive up demand, and thus, the stock price.

Netflix's stock is trading approximately 6.4% below its 50-day moving average of $117.39 and about 2.8% below its 200-day moving average of $113.07, indicating a bearish short-term trend relative to these key indicators. (I've looked at hundreds of these reports, and this particular comparison to moving averages is unusually pessimistic.) The relative strength index (RSI) stands at 43.01, suggesting that the stock is in neutral territory, neither overbought nor oversold.

The calculated support level is at $107.33, which could serve as a critical point for buyers to step in if the price continues to decline. Conversely, resistance is identified at $113.48, where selling pressure may increase.

Beyond the Split: Netflix's Bigger Picture

To truly understand the impact of the stock split, we need to look beyond the immediate price action and consider the broader context. Netflix reported third-quarter revenue of $11.51 billion, growing in line with forecasts. They're guiding for fourth-quarter revenue of $11.96 billion versus analyst estimates of $11.90 billion. That’s a slight beat.

However, the stock split announcement came after Netflix reported third-quarter earnings that missed analyst expectations on the top and bottom lines. Was the split a distraction? A shiny object to divert attention from less-than-stellar results? It's possible. Companies often use these kinds of financial maneuvers to manage perceptions, especially when the underlying fundamentals are shaky.

The company's split-adjusted 52-week range is $80.93 to $134.11. That's a wide range, indicating significant volatility. And while the stock saw a slight bump of 0.07% to $111.28, this is hardly a ringing endorsement of the split's immediate impact.

Consider Amazon, which is looking to raise $12 billion through a bond sale. According to sources, proceeds from the offering may be used for everything from acquisitions and CAPEX to share buybacks. Amazon seeks $12B in bond sale, Netflix trades after stock split Amazon's bond sale adds to a wave of massive technology debt offerings as companies race to fund AI infrastructure. What does this have to do with Netflix? It highlights the competitive landscape. Netflix isn't operating in a vacuum. They're competing for eyeballs (and investor dollars) with companies making massive investments in new technologies.

So, What's the Real Story?

The Netflix stock split, on its own, is a non-event. It's financial engineering, not fundamental change. The company's future hinges on its ability to generate revenue, control costs, and compete effectively in the streaming wars. The stock split is a sideshow.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

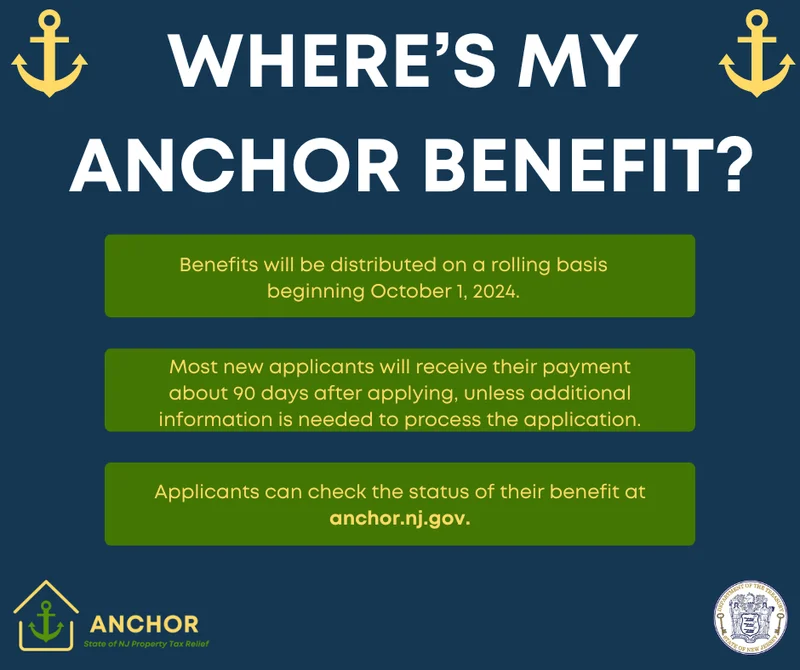

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: The Split, Price Today, and What's Next

- NVDA Earnings: What to Expect and When – The Future is Coming

- Pump.fun: Price predictions and... why?

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)