Stock Market Tumbles: Frozen Data vs. Rate Cut Hopes

Okay, so the market took a dive on Thursday. The Dow dropped nearly 800 points – 797.84 to be exact – a 1.65% haircut, landing at 47,456.98. S&P 500 mirrored that drop, also down 1.65%, and the Nasdaq got hammered, shedding 2.3% to close at 22,870.36. The headline? The government shutdown screwed everything up. But let's dissect that.

Beyond the Shutdown Narrative

The convenient narrative is that the shutdown caused all this. No economic data for two months will do that. But let’s not be naive. The White House is already hinting that October's CPI and jobs reports might be MIA. Convenient, right? Blame the shutdown for hiding potentially bad news.

Tech stocks took the brunt of the hit. Tesla and Palantir tanked, down 7%. Nvidia and Broadcom weren't far behind, dropping 4%. This isn't just about missing data; it's about inflated valuations finally facing a reality check. Are investors really that surprised that growth can't continue at the same pace forever? Or did the shutdown provide a handy excuse to take profits?

The bond market is also whispering something interesting. The 10-year Treasury yield nudged up to 4.09%. Not a massive jump, but it signals a shift in expectations. The probability of a December rate cut by the Fed is now hovering around 50% (it was closer to 95% last month). The bond market is rarely wrong, and it's saying the Fed isn't as dovish as everyone thought.

Data Gaps and Fed Uncertainty

Here's the core problem: the Fed is flying blind. Without reliable economic data, how can they make informed decisions about interest rates? September data might be released soon, but that's ancient history in market terms. And Capital Economics is suggesting that the BLS might not even publish October's labor market data.

This is where it gets tricky. The market hates uncertainty. But is the lack of data more dangerous than bad data? I suspect the latter. Investors are uneasy, sure, but I'd argue they're more afraid of what the data might reveal if it were available.

The missing economic reports are like a magician's smoke screen. The audience (investors) is distracted by the spectacle (shutdown), while the real trick (underlying economic weakness) remains hidden. The question is: what happens when the smoke clears?

And this is the part of the report that I find genuinely puzzling. Why would the White House telegraph the potential absence of key economic reports? Usually, administrations try to spin data, not bury it. Is the news that bad?

The Real Culprit? Valuation, Not the Shutdown.

So, did the shutdown really crash the market? I'm not buying it. It's a convenient scapegoat, but the underlying issues were there all along. Overvalued tech stocks, rising bond yields, and a Fed facing a data vacuum. The shutdown just accelerated the inevitable correction.

The investor reaction tells us something, too. Carol Schleif at BMO Private Wealth anticipates market volatility as economic data resumes. Expecting volatility after the data returns? That suggests the fear isn't about the shutdown itself, but about what the data will show when it finally emerges. Frozen economic data could mean no December rate cut — and investors are rebelling - Business Insider

It's like diagnosing a patient without lab results. You can guess, but you're probably wrong. In this case, the market's diagnosis (shutdown caused the crash) is based on incomplete information. My analysis suggests that the underlying condition (valuation) was the real problem.

So, What's the Real Story?

Markets hate uncertainty, but they really hate being wrong. The shutdown provided a perfect cover for a much-needed correction. Don't blame the messenger (the shutdown); blame the message (inflated valuations).

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

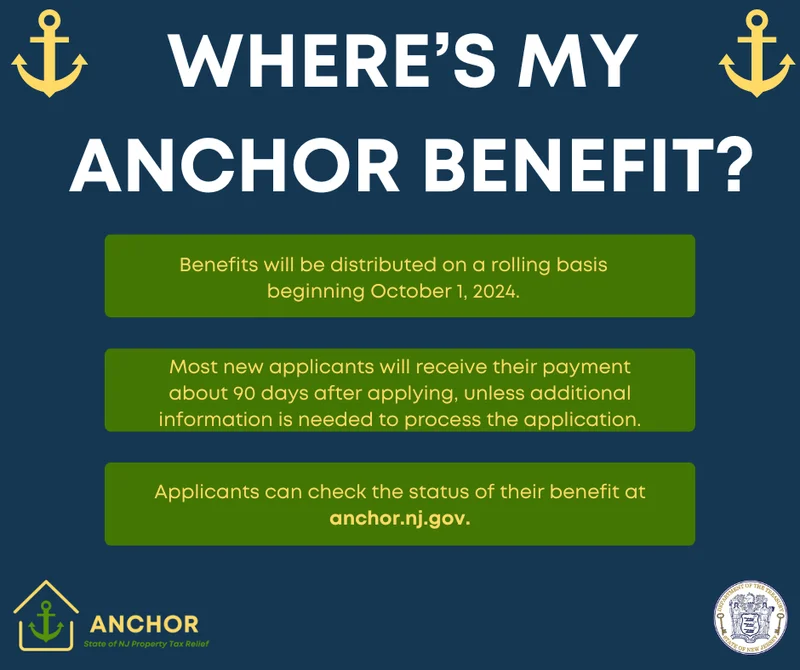

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: The Split, Price Today, and What's Next

- NVDA Earnings: What to Expect and When – The Future is Coming

- Pump.fun: Price predictions and... why?

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)