Bitcoin Crashing: What Happened and Why It Matters

Bitcoin's $98K Crash: Is This the End, or Just a Really Ugly Speed Bump?

Okay, so Bitcoin's tanking again. Down to $98K? Please. Wake me up when it's back to being worth less than a used Honda Civic. Remember those days? Good times.

Seriously though, everyone's acting like this is some kind of unprecedented disaster. "Oh no, Bitcoin is down 2%!" Give me a break. This is crypto. Volatility is its middle name. It’s like complaining that the ocean is wet.

The Usual Suspects

Of course, they're trotting out the usual excuses. "Long-term holders are selling!" Yeah, no kidding. What else are they supposed to do, HODL until they're living in a cardboard box? "Institutional buying has dropped!" Well, duh. Institutions are about as predictable as a toddler on a sugar rush. One minute they're all in, the next they're running for the hills.

And then there's the government shutdown nonsense. Apparently, that was supposed to be good for Bitcoin? Some genius, Timot Lamarre, calls Bitcoin a "canary-in-the-coal-mine for liquidity drying up." Okay, Timot. So, what happens when the canary just lays there, dead? Does that mean the whole mine is about to explode? Because that's kinda how I'm feeling right now.

Here's the thing, though. The White Whale, some random dude on X (formerly Twitter, still a dumpster fire), is blaming the end of the shutdown for the crash. Says the "resolution" is just a temporary fix. Maybe he's right. Maybe we're all being played. But is the shutdown really to blame? Or is it something else entirely?

The Nasdaq Connection (and Why It Sucks)

Wintermute (whoever they are) says Bitcoin is acting like a high-beta tail of macro risk, reacting more strongly to stock market drops than gains. Translation: Bitcoin's become the annoying little brother of the Nasdaq. It copies all its bad habits but never gets any of the rewards.

And apparently, liquidity is thinner than ever. Stablecoin issuance has stalled, ETF inflows have slowed, and exchange depth hasn’t fully recovered. Great. So, it's harder to buy and sell. Makes perfect sense in the world of crypto.

But here's what really gets me: JPMorgan analysts are saying Bitcoin's production cost of $94,000 acts as a "historical price floor." So, basically, it can't go below that, right? Except…it already almost did. Are we supposed to believe these guys? These are the same geniuses who predicted Bitcoin would be at a million dollars by now, offcourse.

The ChatGPT Prophecy

And just to add another layer of absurdity to this whole clown show, ChatGPT is now weighing in. Apparently, the AI overlord thinks Bitcoin could crash to $50,000 by August 2026. Citing "tightening liquidity, ETF outflows, institutional profit-taking, and a break below key supports." Sounds terrifying. We asked ChatGPT when Bitcoin will crash to $50,000; Here’s what it said Sounds terrifying.

But then again, ChatGPT also says that if "macro conditions remain stable," Bitcoin could just have a "milder pullback" to $70,000-$80,000. So, which is it, Skynet? Are we doomed, or just slightly inconvenienced?

Honestly, I'm starting to think this whole thing is one big, elaborate joke. They expect us to believe this nonsense, and honestly... I don't know what to believe anymore. Maybe I'm just getting old.

So, What's the Real Story?

Look, I'm not gonna lie. This dip is concerning. But panicking ain't gonna help. Is this the end of Bitcoin? Probably not. But is it a sign that the glory days are over? Maybe. One thing's for sure: this rollercoaster ride is far from over, and I'm starting to feel a little queasy.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

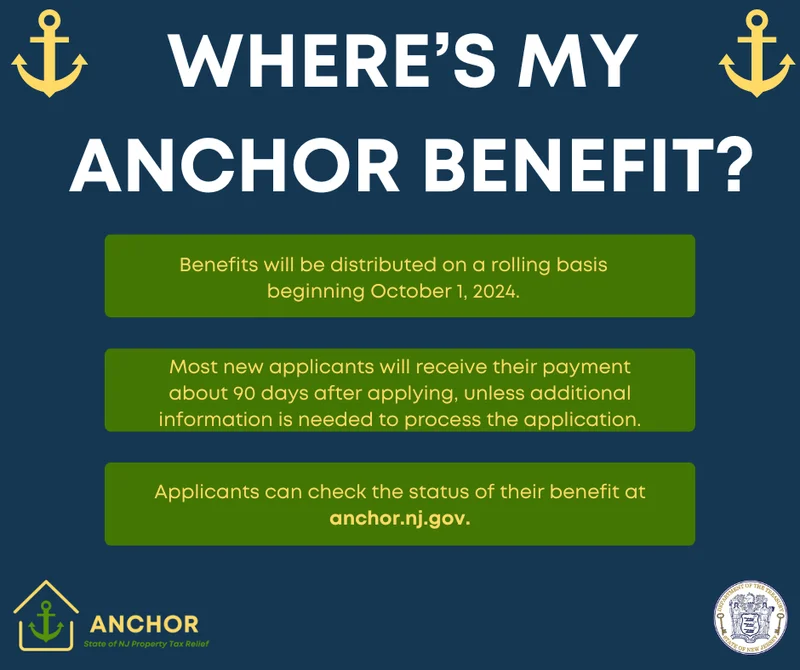

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- NVDA Earnings: What to Expect and When – The Future is Coming

- Pump.fun: Price predictions and... why?

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Starknet Token Price Surge: What's Behind the Rally?

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)