GOOG Stock's Berkshire Bet: AI Stakes and What We Know

Michael Burry's AI "Fraud" Claims? Nonsense. It's Exponential Growth We Can't Even Fathom

Okay, folks, let's talk about Michael Burry. Yes, that Michael Burry, the guy who famously (and correctly) predicted the 2008 housing crash. Now he's waving his hands, warning about an AI bubble and accusing tech giants like Alphabet (GOOGL) and Meta (META) of "fraud" by understating depreciation. He estimates that hyperscalers will understate depreciation by $176 billion between 2026 and 2028, while specifically calling out Oracle (ORCL) and Meta Platforms (META) for overstating earnings by 26.9% and 20.8%, respectively, by 2028. Is GOOG Stock a Buy or Sell as Michael Burry Accuses Hyperscalers of ‘Fraud’?

Honestly? I think he's missing the forest for the trees. He's so focused on the accounting that he's ignoring the sheer, breathtaking potential of what's happening right now.

Burry's argument, as I understand it, is that these companies are artificially inflating their earnings by extending the lifespan of their assets, specifically the massive infrastructure they're building for AI. Alphabet, for example, doubled the network/compute useful life to six years since 2020. Sure, that might give them a short-term boost, but what happens when that infrastructure unlocks even more innovation, and even more growth?

Let me ask you this: when Gutenberg invented the printing press, did people worry about the depreciation of the metal type? Probably. But did that stop the explosion of knowledge and culture that followed? Of course not! This is bigger than accounting tricks; this is a paradigm shift.

The Real Story? Exponential Growth

The "Big Idea" that everyone seems to be missing is the compounding effect of AI. It's not just about faster search results or better targeted ads. It’s about creating systems that can learn, adapt, and improve themselves at an accelerating rate.

Think about Alphabet's Tensor Processing Units (TPUs). Anthropic plans to buy as many as 1 million of these! That's a revenue opportunity worth billions, sure, but it's also an opportunity to create even more powerful AI, which in turn will drive even more demand for TPUs. And Google has managed to maintain its dominant market position in Search and has several growth drivers that can take the stock higher. These include YouTube, which I have said multiple times is a key growth catalyst and an underappreciated part of its arsenal. The company’s Cloud business also continues to benefit from growing demand, and along with Microsoft (MSFT), Google continues to gain market share at Amazon's (AMZN) cost.

It's a virtuous cycle, a feedback loop of innovation that's unlike anything we've ever seen. Uttam, a growth-oriented investment analyst whose equity research primarily focuses on the technology sector, recently covered Alphabet’s resilient cloud strategy.

I saw a comment on a Reddit thread the other day that really resonated with me: "AI is the new electricity. It's going to power everything." And that's exactly right. It's not just one product or one service; it's the underlying infrastructure for everything.

And that’s where Alphabet's Waymo comes in. Alphabet doesn't have much respect for its Waymo self-driving business, which it has expanded globally to Japan and the U.K.

Of course, there are risks. Europe is already scrutinizing Google's practices, with the E.C. announcing formal proceedings to assess whether Google applies fair, reasonable, and nondiscriminatory conditions of access to publishers' websites on Google Search. If it decides against Google, though, the EC has the power to fine Alphabet "up to 10% of the company's total worldwide turnover," and potentially "up to 20% in case of repeated infringement."

We need to be mindful of the ethical implications, the potential for bias, and the need for responsible development. But fear shouldn't paralyze us. We need to embrace the potential while mitigating the risks.

When I first started following AI, I was honestly overwhelmed. It felt like trying to drink from a firehose. But then I realized that it's not about understanding every algorithm or every line of code. It's about understanding the impact – the potential to solve problems, create opportunities, and improve lives on a scale we can barely imagine.

This Isn't a Bubble, It's the Dawn of a New Era

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

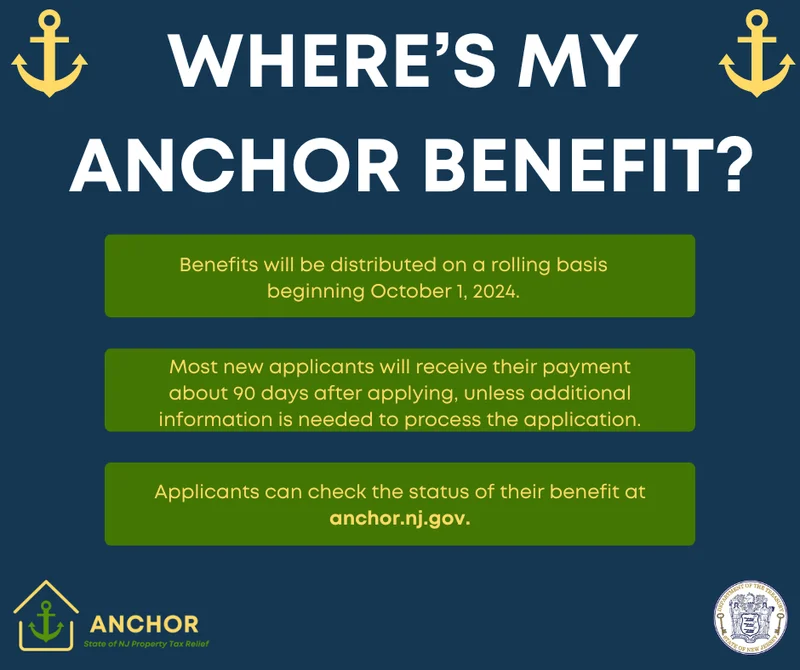

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: The Split, Price Today, and What's Next

- NVDA Earnings: What to Expect and When – The Future is Coming

- Pump.fun: Price predictions and... why?

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)