Cidara Therapeutics Acquired by Merck: The $9.2B Bet

Generated Title: Merck's $9.2B Flu Bet: Genius Move or Desperate Gamble?

Merck's recent announcement that it's acquiring Cidara Therapeutics for a cool $9.2 billion has definitely stirred up the biopharma pot. The headline screams "flu prevention," but let's dissect the numbers and see if this is a calculated strike or a swing for the fences born out of desperation.

The Keytruda Cliff and the Pipeline Problem

The elephant in the room is Keytruda. Merck's mega-blockbuster cancer drug is staring down patent expiration (the dreaded "patent cliff"). Losing exclusivity on a drug that raked in billions annually is a massive blow. The pressure to fill that revenue gap is immense. So, acquiring Cidara, with its experimental flu therapy, looks like a play to diversify and stabilize future earnings. The question is: Is Cidara's tech worth the premium Merck is paying?

Cidara's treatment aims to protect folks who don't respond well to traditional flu vaccines—the elderly and immunocompromised. That's a sizable demographic, but it's not a guaranteed goldmine. Success hinges on clinical trial outcomes, regulatory approvals, and, crucially, adoption rates. And this is the part of the report that I find genuinely puzzling: The article states, "It is also working in earlier stages on cancer therapies." This seems like a non-sequitur, but is it? Is Merck acquiring Cidara for its flu treatment or its cancer therapies?

Decoding the Deal: A Premium Price?

Merck is shelling out $221.50 per share for Cidara, more than double Cidara’s closing price on Thursday of $105.99. A 105.6% jump in share price after the announcement is eye-catching, to say the least. Was Cidara undervalued? Or is Merck overpaying to secure a promising but still unproven asset?

The Financial Times reported the deal was imminent, which gave Cidara a boost. But still, it's a hefty price tag. We're talking about a $9.2 billion cash deal. That's real money, even for a pharma giant like Merck. According to a Merck bets on flu prevention with $9.2 billion deal for Cidara Therapeutics report, the deal aims to bolster Merck's pipeline.

Here's where a bit of skepticism is warranted. High premiums in acquisitions often signal either intense competition for the target company or, less charitably, a degree of desperation on the part of the acquirer. Given Merck's looming patent cliff, the latter explanation seems plausible.

What if the flu treatment fails to deliver on its promise? What if regulatory hurdles prove too high? Or what if newer, more effective flu prevention methods emerge in the next few years? The risk is significant.

Is This Really About Flu?

My analysis suggests this deal is about more than just flu prevention. Merck is buying a pipeline, a portfolio of early-stage assets, and, perhaps most importantly, a team of scientists and researchers. The cancer therapies in "earlier stages" might be the real long-term prize.

The question is: how far along are these therapies? What are the projected timelines for clinical trials? And what's the likelihood of success, given the notoriously high failure rate in oncology drug development? Details on the cancer therapies remain scarce, but the potential upside could justify the hefty price tag—if those therapies pan out.

Desperate Times, Bold Measures

Merck's acquisition of Cidara is a high-stakes gamble. It's a bet on the future of flu prevention and, potentially, cancer treatment. But it's also a reflection of the challenges facing big pharma companies as they grapple with patent expirations and the constant pressure to innovate.

Is this a genius move? Only time will tell. But one thing is certain: Merck is not sitting still. They're making bold moves to secure their future, even if it means paying a premium today.

A Reality Check

Ultimately, this deal feels like a calculated risk born of necessity. It's not a slam dunk, but it's a move that addresses a clear and present danger—the Keytruda cliff. Whether it pays off remains to be seen, but Merck is clearly playing to win.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

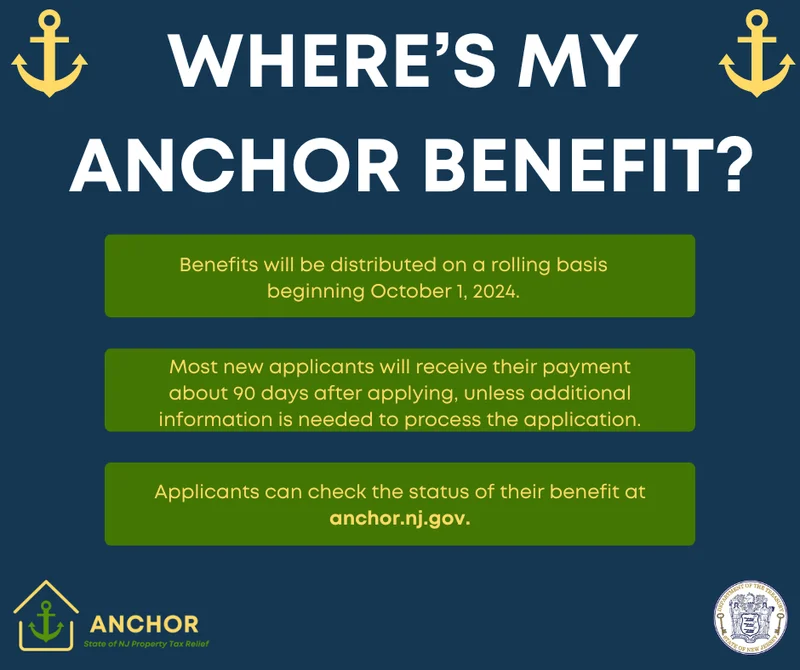

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: The Split, Price Today, and What's Next

- NVDA Earnings: What to Expect and When – The Future is Coming

- Pump.fun: Price predictions and... why?

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)