BABA Stock: AI App Relaunch vs. Wall Street – What Reddit is Saying

Generated Title: Alibaba's AI Gamble: From Wall Street Doubt to World Domination?

Okay, folks, buckle up. Wall Street's whispering doubts about Alibaba (BABA) – I see headlines like "AI Analyst Downgrades Alibaba Stock (BABA) to Hold and Trims Price Target Despite Wall Street Optimism" – but I'm seeing something completely different. While some analysts are trimming price targets, focusing on short-term cash flow concerns, Alibaba’s playing a much bigger game. They're not just trying to win the quarter; they’re building the future.

They’re betting big on AI, and honestly, it's the kind of audacious move that makes my heart race.

The Qwen Revolution is Coming

Let's talk about Qwen. Alibaba is pouring resources into revamping its AI app, aiming to create something that rivals, maybe even surpasses, ChatGPT. Imagine an AI assistant not just answering questions, but actively helping you shop on Taobao, navigating Alibaba’s vast ecosystem with personalized insights. This isn't just about better recommendations; it’s about creating a truly intelligent shopping experience.

And get this: they're not just tweaking existing apps. They’re rebuilding them from the ground up, integrating "agentic AI capabilities." What does that mean? It means Qwen will be able to act on your behalf, learning your preferences and automating tasks. Think of it like having a personal shopper who actually knows you, anticipating your needs before you even realize them.

Now, some might say, "But Dr. Thorne, isn't Alibaba facing competition from Baidu, Tencent, everyone?" Absolutely! But Alibaba has a unique advantage: its massive e-commerce platform. They have a treasure trove of data to train their AI, giving Qwen a deep understanding of consumer behavior and market trends. It's like having a crystal ball for retail, powered by AI.

Remember when the printing press was invented? Suddenly, information wasn't just for the elite; it was democratized, accessible to the masses. I see a similar paradigm shift happening with AI. Alibaba isn't just building a better chatbot; they're building a platform that could democratize access to personalized services, empowering consumers in ways we can only begin to imagine.

This is the kind of breakthrough that reminds me why I got into this field in the first place.

And it's not just talk. Alibaba's Qwen3-Max AI model outperformed top U.S. and Chinese rivals in a live crypto trading challenge, turning a $10,000 investment into a 22.32% gain, while OpenAI's GPT-5 plunged 62.66%! Numbers don’t lie.

Of course, there are challenges. Scaling AI is expensive, and weak free cash flow is a legitimate concern. But I believe Alibaba's long-term vision justifies the investment. They're not just chasing short-term profits; they’re building a sustainable AI ecosystem that could transform e-commerce, cloud computing, and countless other industries.

And let's not forget Alibaba's commitment to tech self-sufficiency in China. They're developing new AI inference chips compatible with Nvidia's (NVDA) platform, investing billions in AI and cloud infrastructure. This isn't just about competing with Western tech giants; it's about creating a robust, independent AI ecosystem within China.

But, with great power comes great responsibility. As AI becomes more integrated into our lives, we need to address ethical concerns about data privacy, algorithmic bias, and the potential for job displacement. We need to ensure that AI benefits everyone, not just a select few.

So, what does this mean for you? It means that BABA stock price could be a steal right now. Wall Street's focusing on the short-term headwinds, but I'm seeing a long-term opportunity. Alibaba is making a bold bet on AI, and if they succeed, the rewards could be enormous. But more importantly, what could it mean for us?

Alibaba's Not Just Competing; They're Building a New World

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

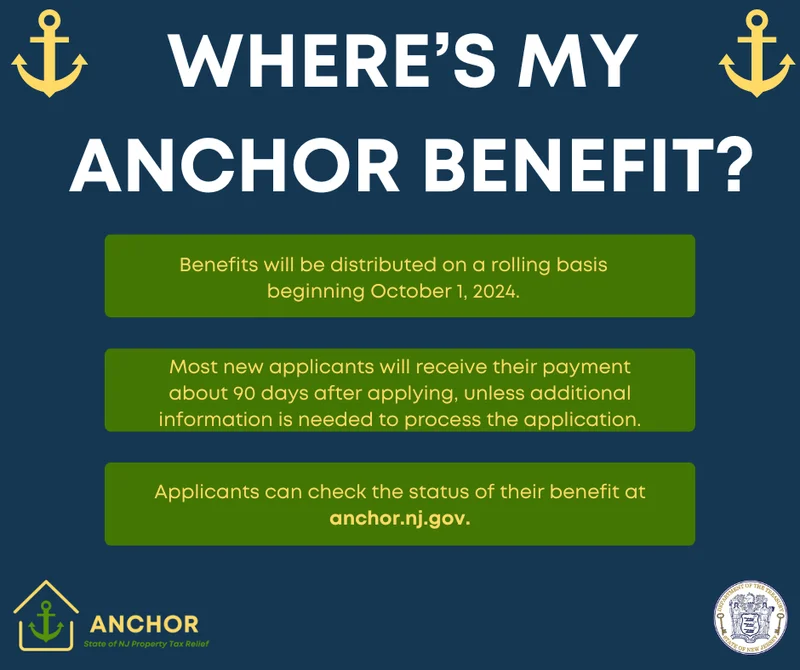

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Netflix Stock: The Split, Price Today, and What's Next

- NVDA Earnings: What to Expect and When – The Future is Coming

- Pump.fun: Price predictions and... why?

- Microsoft Stock: Price Trends and Investor Sentiment

- SpaceX Launch Today: What We Know and the Schedule – A New Dawn

- Nvidia Stock Price Today: What's Happening and Why You Should Probably Panic

- XRP Price: Whale Activity, Predictions, and What's Next

- Firo Hard Fork: What It Means and the Road Ahead

- Gabe Newell's Gigayacht: Net Worth, Steam Deck, and the Internet's Reactions

- Caldera: No Impact on Youth? Yeah, Right.

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (29)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (6)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)